Earn

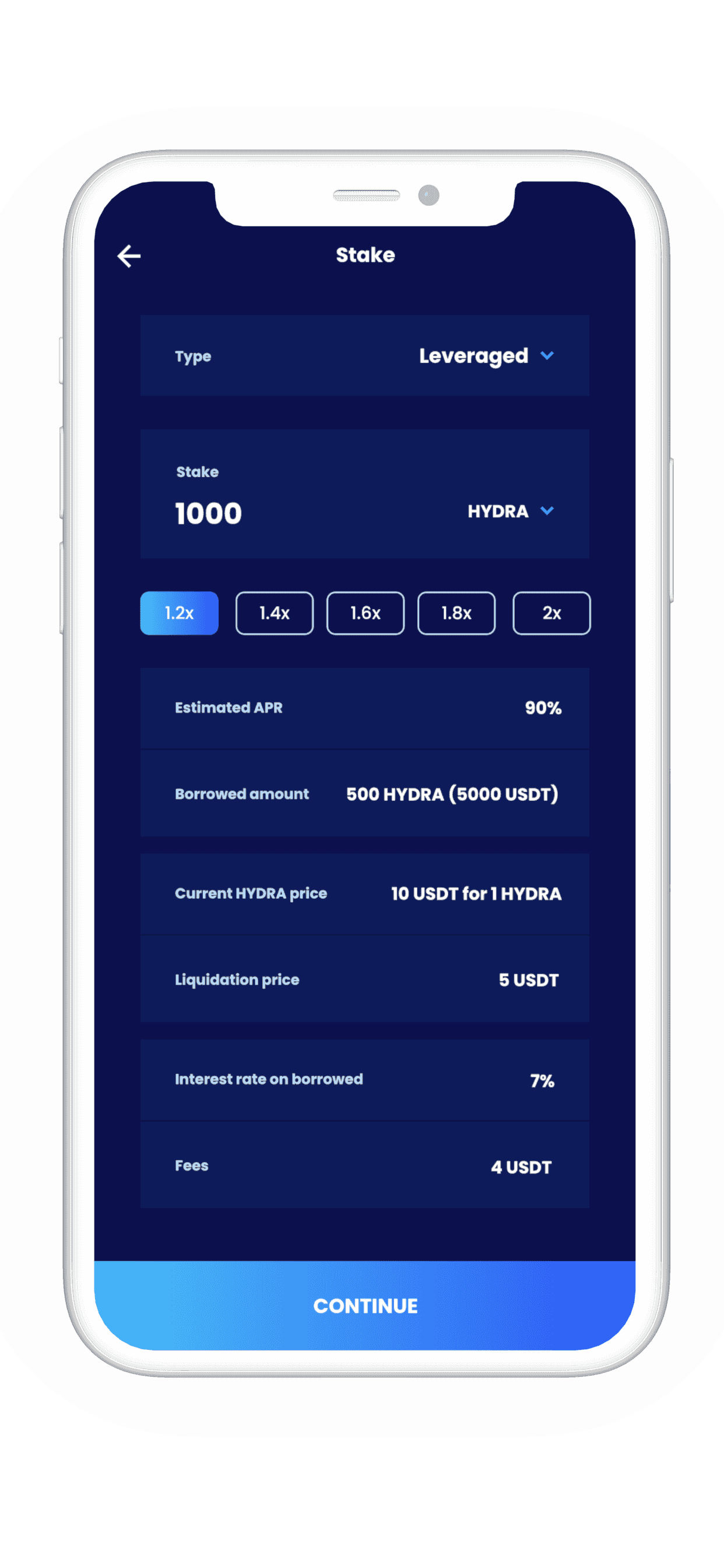

Leveraged Staking Product

ChangeX’s Leveraged Staking is among the world’s first, and is specifically designed for PoS and inflationary assets in order to boost APR. By harnessing the power of collateralized staking pools, Leveraged Staking maximizes APR by a factor of 1.2-2x, while also powering a stablecoin lending market.

Use

Universal Crypto Visa Card

The ChangeX Visa will allow instant access to HYDRA and other assets without interrupting staking on your interest-bearing assets. Access your funds, while they work for you in the DeFi ecosystem.

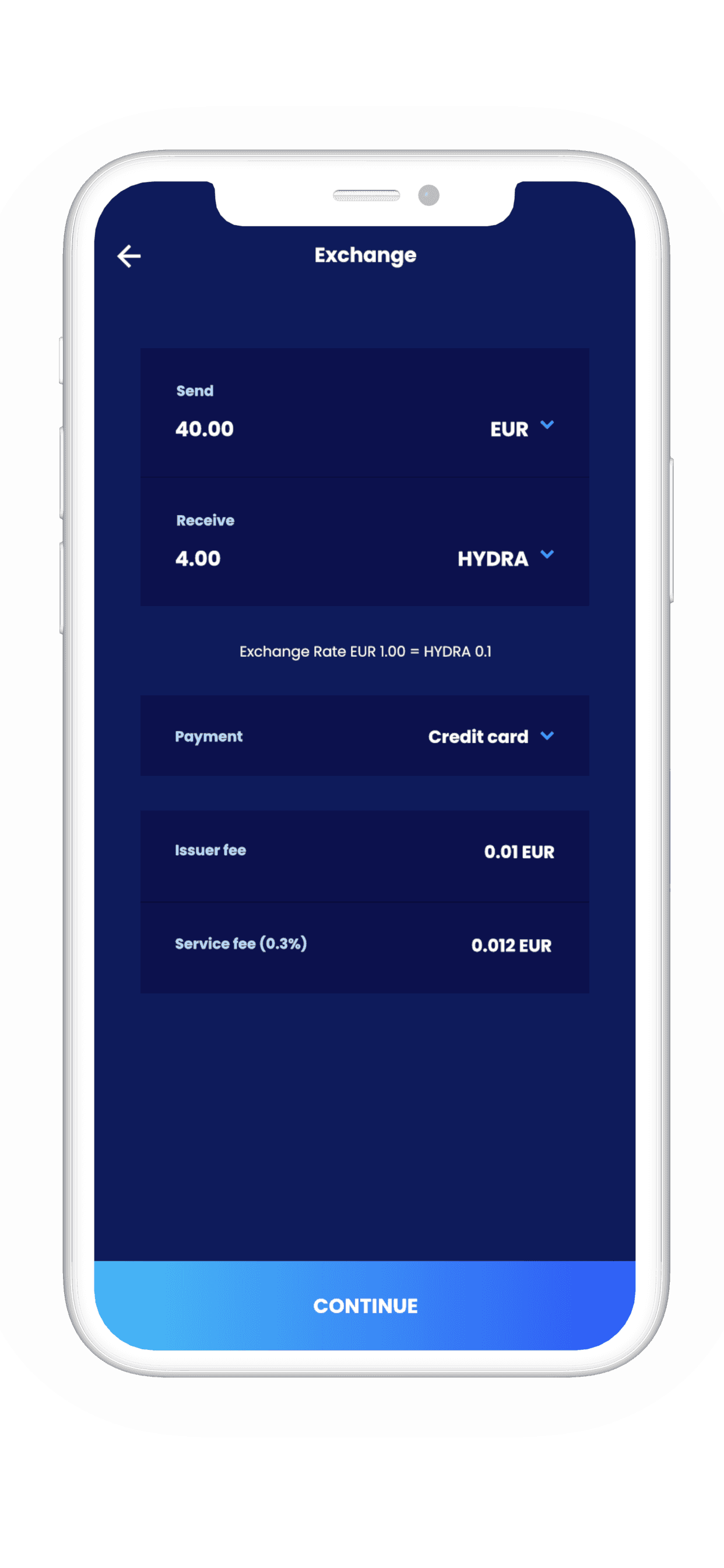

Trade

Fiat-to-Crypto and back

ChangeX’s cross-chain bridges will bring a plethora of cryptocurrencies, otherwise widely unavailable, at your fingertips. By combining the existing liquidity in the DeFi and CeFi worlds, this simple experience would allow even the most inexperienced users to enter the world of crypto.

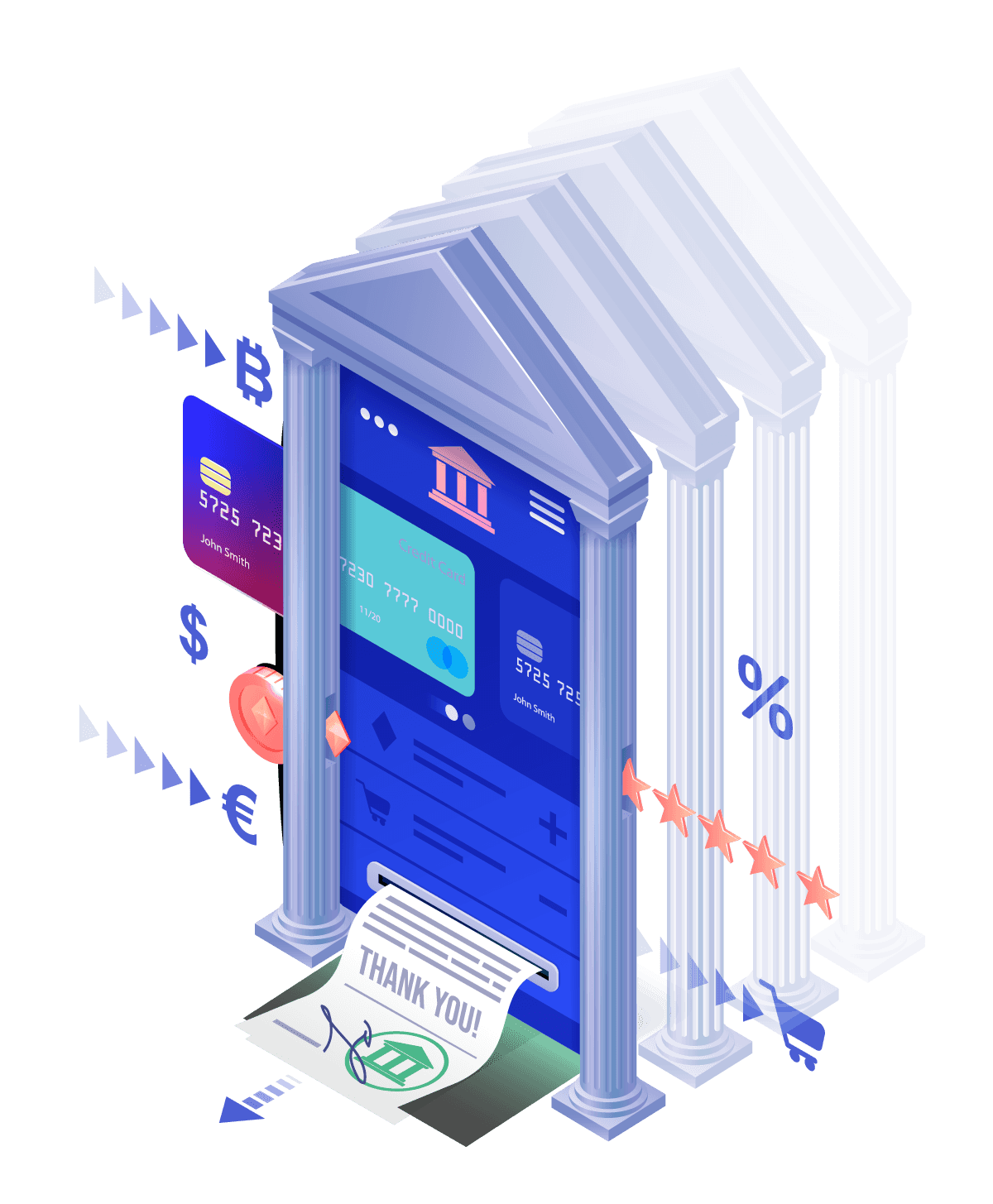

Control

Personal IBANS for SEPA Banking

By obtaining an Electronic Money Institution (EMI) license for EUR banking capability, ChangeX will allow you to control all of your assets – both fiat and crypto – in a single interface.

Additional Product Features

Flexible Staking Pools

One-click access to staking HYDRA and other PoS assets

DeFi Wallet

You are in control of your private keys and seed phrase

Crypto-to-Crypto Trading

On all pairs in the app

NFT Wallet

Securely hold and transfer your purchased NFTs with the click of a button

Stablecoin Lending Market

Lend for an attractive APR and power the Leveraged Staking economy

"Earn" Product

Enabels fixed APR for stablecoins

Next-Gen

Composable DeFi Economics

DeFi Composability enables economic systems to interact with each other and create synergies in order to improve outcome probability. ChangeX aims to offer a mobile-friendly app interface that will tap into this opportunity. Non tech-savvy individuals will be able to take advantage of non-custodial industry-leading products such as cross-chain bridges, staking, lending, DAOs, and collateralized staking in Lego-like combinations that aim to provide lower risk with higher reward. If blockchain's complex and interoperable ecosystem is the backend, then ChangeX is the front-end, the keys to unlock everything, make sense of it, and make it accessible. DeFi, crypto, banking – true composability is only possible when everything is included into one package. At ChangeX, that’s exactly what we want to achieve.

The Platform

In-brief

The ChangeX platform strives to streamline the entire crypto experience by merging CEX and DEX tools with in-app functionality like staking and lending, while allowing you to spend your digital assets with a ChangeX Crypto Debit Card..

Trade, store, and earn against your crypto – ChangeX has you covered

- You are in complete control of your assets. Your keys, your coins.

- Forget about switching between DEXs – swap tokens in-app at the best rates.

- Earn high APR on PoS Assets and track your earnings.

- Among the first leveraged staking products without ever leaving the app – up to 2x on base APR.

- Store all your ERC 721 and ERC 1155 standard NFTs inside the ChangeX app.

- Crypto in real life – use the ChangeX debit card to pay with your digital assets.

- Multiple payment methods supported in the app for the easiest access to your crypto.

- No more need to leave the app – your bank account is here and it blends right in.

ChangeX is powered by

The CHANGE token

CHANGE is the governance token of the ChangeX app. It is a deflationary HRC20 token (HydraChain), which offers high APR to holders by acting as a bridge to the staked inflationary assets in the app, where rewards will be paid out in CHANGE.

30% of all crypto-crypto and fiat-crypto trading fees in the app will be used to power a burn mechanism to reduce total supply, thus driving the price upwards.

CHANGE will also provide governance rights to holders, allowing them to vote on new additions to the ecosystem.

Token Sale

$CHANGE ICO’s tokensale phase closed on June 1 with 1.8x oversubscription. We are currently in the commitment phase, where users have until July 1 to pay for the rest of the CHANGE they subscribed for. Below is a breakdown of the token allocation.

- Public Sale ($2.4M)

- Treasury

- Tier 1 Institutionals

- Launchpads & IEO

- Liquidity

- Founders & Team

- Staking Pool for first 9 months

- Airdrop

$2.4M

150,000,000 CHANGE

$0.016

$100,000

USDT, USDC, UST, BUSD, BTC, ETH, Hydra and more

3% of subscribed amount

None

28 Feb 2022

31 May 2022

1 June 2022

30 June 2022

First Week of July 2022

Timeline

Road Map

This is a highly tentative roadmap that shows how the ChangeX vision will unfold

- Research for Leveraged Staking & DeFi Products

- MVP - Non-custodial wallet with a few supported cryptocurrencies, incl. HYDRA

- Prototyping Composable Earn Products

- Establish Legal entity

- Secure Seed Investment from HYDRA & LockTrip

- Team Structuring

- HYDRA SDKs for Swift, Kotlin and Go

- Official release of ChangeX v1 wallet

- Release of Open Beta of ChangeX wallet

- Start Process for Obtaining Crypto License in Lithuania

- Sign agreement for AML Services with Tier 1 Partner

- Conduct Private and Public Sales

- HydraDEX Launch

- Staking on CHANGE Begins

- Launchpad Events

- Also In-wallet DeFi swaps

- Support for 10 coins and tokens in wallet

- Support for additional chains and tokens

- Third-party fiat on-ramp with direct fiat purchases

- Leveraged Staking Functionality

- HYDRA, CAKE, BNT and other high APR assets

- Open Lending Market

- Electronic Money Institution (EMI) Licensing or Agency

FAQ

Frequently asked questions

Please find frequently asked questions pertaining to the tokensale event and their answers below.

What does Enrollment and Subscription mean?

The tokensale will be executed with an optimum risk/reward setup and an extremely limited market cap equivalent to just $2.4M of tokens. The first Phase is the Enrollment, where each user will Subscribe the amount that he/she would like to buy. During the Enrollment phase, users will deposit 3% of the final amount.

What would happen if there is an oversubscription?

In case of an oversubscription, the quota will be adjusted proportionately to all participants. For example, if someone has enrolled for $10,000 of CHANGE tokens, and there is a total of 2x oversubscription on the market cap ($4.8M instead of $2.4M), this would mean that the quota will be reduced by 50% for all participants. The goal is to allow a fair distribution where everyone gets equal treatment regardless of subscription size.

Can I stake CHANGE if I used self-vesting?

There is a trade-off between buying at the ICO and buying from the HYDRA DEX. Investors who bought at the ICO make sure they bought at $0.016 and also that they can use self-vesting, but being unable to stake until the end of the lock-up period. DEX buyers will buy at an uncertain price, but will have the ability to stake immediately once staking is online.

What is the benefit of buying at the HydraDEX launch??

The CHANGE token will be traded against HYDRA and/or DAI with a total supply of 30 M tokens and corresponding 480,000 USD in HYDRA and/or DAI. Meaning that the starting price will be the same as in the ICO - $0.016 per token. However, demand should move the price up and the exact price at which you will be able to buy is not guaranteed. Buying at the DEX, however, gives you the opportunity to immediately stake CHANGE, and with only 67 million tokens in circulation for the 11 months following September, which is the result of all the vested CHANGE, the APR should be quite significant.

Why can’t I stake vested CHANGE?

When you vest your CHANGE, you lock those tokens for a certain time period and reduce the circulating supply of CHANGE tokens. This, however, does not stop you from buying at the IDO in order to stake CHANGE and enjoy the high APR, which gives you a mix of the two strategies. CHANGE tokens will be released to ICO buyers on September 30 to those that are not self-vesting. The ICO participants that are self-vesting will receive their tokens according to the selected period, so If e.g. somebody is self-vesting for 6 months, they will receive their tokens on March 31, 2023.

When will CHANGE staking be available?

The ChangeX app and CHANGE staking will be available in July for users who bought the token from the HYDRA DEX. Investors who bought during the ICO subscription phase will receive their tokens in September without self-vesting or according to the self-vesting period they opted for.

What happens with the deposit if I subscribe for an amount that I can't cover?

The 3% deposit has a symbolic size relative to the subscription. It aims to incentivize participants to subscribe for realistic amount in order to have a fair and responsible event. In case a participant enrolls for an amount that he/she isn't able to cover afterward, the deposit will be deducted as a penalty fee. The user will still be able to participate with a lower amount and he/she will still have access to the event.

Are there any country limitations for participating?

Residents of the USA, Canada, Singapore, and China are not allowed to participate. Any KYC and/or applications from members of these countries will be automatically disqualified.

How does the CHANGE token work?

The CHANGE token has a unique utility of facilitating the DeFi products in the ChangeX platform. Leveraged staking pools, trading pairs, and all transactions in the app will interact with the CHANGE token. A ~5% network fee generated by the staking pools will be airdropped to CHANGE token owners as rewards, thus creating a bridge between the staked inflationary assets and the deflationary economy of CHANGE. Additionally, the CHANGE token will act as the governance token for the ChangeX DAO, providing voting rights to users, while 30% of all trading fees in the app will be used to burn the total supply and stimulate deflation.

Does the team behind the project have any track history?

Six of the co-founders have extensive experience in the world of blockchain. Together, they have 3 successful projects behind themselves with a combined market cap of 600M USDT – HYDRA, LockTrip, and Bitcoin Gold, all having distinct models, unique attributes, and active communities.

What happens after the commitment phase ends?

The commitment phase will end on June 30 at 00:00 EEST. Once that is over, CHANGE will make its appearance on the HYDRA DEX for a liquidity event, where investors can buy the token and stake it immediately once staking is online in the app. We will then work proactively to get CHANGE listed on more exchanges and launchpads.

If I pay the deposit with one cryptocurrency, can I make the final settlement with a different one?

Yes, we want to make the procedure as flexible as possible and will strive to support all flagman coins and stablecoins. You can enroll in Phase 1 with any of the supported coins, and afterwards commit the final amount in Phase 2 again with a different coin from the supported list.

Will there be any institutional investors?

There will be an invite-only private placement intended for tier 1 institutional investors with an allocation of $0.8M. Only selected entities with a solid reputation will be invited for discussions. The price will be identical to that for all other participants.

Will there be a cap per participant?

The default cap per participant is $100,000 equivalent.

The quota will be very limited, how can I buy more?

Shortly after the finalization of the settlement phase, there will be a public DEX event with significant liquidity. It will allow anyone to top-up their desired quantity at aftermarket terms.

MEET THE TEAM

Executive team

The ICO Crypto Team combines a passion for esports, industry experise & proven record in finance, development, marketing & licensing.

Nick Iliev

CEO and Co-founderNick breaths blockchain ever since 2014.Starting with mining he then created the go-to crypto platform in Bulgaria, xChange.bg in 2016. Nick also co-founded RocaPay, a crypto merchant payment gateway. He has a unique background in both IT and Finance with an MSc in Finance and MCSE/CCNP licenses

Gary Guerassimov

Co-founderGary is a serial entrepreneur with 15 years of experience in management and business development. Co-founder of xChange.bg and Finexify, a DeFi investment fund with $6+ M AUM. He holds a BA in International Business Management from DeVos Graduate School.

Petya Nankova

COOFinance professional with vast experience in VC, M&A and FX. She oversaw, managed and was instrumental in the growth of xChange.bg, the leading crypto platform in Bulgaria. She holds an MSc in Finance & Investments from Erasmus University Rotterdam.

Martin Kuvandzhiev

CTOMartin is a core developer at Bitcoin Gold, a blockchain speaker/advocate and an entrepreneur with vast experience in Startups and Fintech. Martin has also built Assetify, а service provider for crypto-backed loans and is leading 20+ developers focused on blockchain technologies.

Nikola Alexandrov

Strategy & Token ArchitectureNikola is a co-founder and ideator of HydraChain (HYDRA) and CEO of LockTrip.com (LOC). He has seven years of experience with liquidity and HFT systems. He co-founded the Bitcoin7 exchange, top 3 by volume back in 2011. Nikola holds a BA in Business Administration from Portsmouth University.

Hristo Tenchev

Crowdfunding OperationsCo-founder of LockTrip and Bitcoin7. Founder of xs-software.com, a gaming company with more than 50M registered players. Cofounder at Softuni.bg - an innovative IT education center with more than 300,000 students. He was listed in the European Forbes “30 under 30” as one of the most successful entrepreneurs in 2016.

Petko Krastev

Risk & ComplianceAudit and compliance professional with experience in managing compliance risk in the private banking, wealth management, and cryptocurrency sectors. Petko holds an MSc in International Business Economics from KU Leuven

Florian Pfeiffer

Strategy & DesignCCO and Partner at LockTrip and advisor to GoMeat. His engineering background helps him design tools for automating operations. His passion for data, finance, and innovation led him into the world of crypto.

MEET THE TEAM

Advisory board

With more than 50 years of combined experience in M&A, investment banking, and management, our advisors are focused on helping us grow and expand by raising capital and guiding us with our strategic decisions.

Dimiter Gurdjilov

Advisory board memberSenior M&A and investment professional with 25+ years of experience with Merrill Lynch Asset Management, JPMorgan, George Soros’ Bedminster Capital and NBGI Private Equity in New York, Sydney and London. As an M&A Banker at JPMorgan, he executed transactions with value in excess of $80bn. As an investment principal at Bedminster and NBGI PE, led investments in numerous transactions with cumulative IRR in excess of 75% and 50%, respectively. Dimiter holds an MBA in International Finance from University of Miami and a BA in Business Administration & Economics from the American University in Bulgaria.

Stefan Ivanov

Advisory board memberSenior Banker with 25+ years of experience with Citibank, Banque Paribas and Challenger Capital Management. Served as CEO of Citibank in Bulgaria bringing the bank to #1 position. Held senior roles with Citi in London, Sao Paulo, Seoul and Tunisia. Traded derivatives at Banque Paribas in New York and on the floor of the American Stock Exchange in New York. Chairman of the Audit Committee of UBB - KBC Group in Bulgaria. Stefan is an alum of Harvard Business School and holds an MBA in Financial Engineering from Cornell University and a BA in Business Administration from the American University in Bulgaria. What is more, in 2020, Stefan and his son crossed the Atlantic on a self-made boat, entirely on their own, with the mission to raise awareness for an organ transplant program!

Neil Cunha-Gomes

Advisory board memberOver the past 5 years, Neil has led a number of high-profile investments globally at the SoftBank Vision Fund, which has over $100 billion AUM, where he focuses on Growth Equity and Crypto investing. His crypto investments include Consensys (one of the most reputable brands in the industry, behind flagship projects such as MetaMask) and Elliptic (one of the most trusted crypto compliance solutions providers). His 10+ years of investing experience is a perfect addition to the ChangeX advisory board.

Partners

Supported By

Contact

Get In Touch

Any question? Reach out to us and we’ll get back to you shortly.